The Shanghai Export Containerized Freight Index based on Settled Rates (SCFIS in short) shows the trend and extent of changes of the settled rates of Shanghai's spot export container transport market, which indicates the average level of settled rates after departure of voyages.

I. SCFIS overview

Port of departure: Shanghai

Ports of destination: the basic ports of individual trade lanes. The basic ports of the Europe service are Hamburg, Rotterdam, Antwerp, Felixstowe and Le Havre. The basic ports of the American west coast service are Los Angeles, Long Beach and Oakland.

Term of transportation: CY to CY

Container type and size: dry cargo container of 20GP, 40GP and 40HQ.

Cargo type: general cargo

Means of payment: freight prepaid

Rate composition: basic ocean freight and surcharges per unit, and the surcharges include BAF/FAF/LSS, CAP, PSS, WRS, PCS, SCS/SCF/PTF/PCC and other surcharges in US dollars per unit.

Billing currency: US dollar

Base period: SCFIS EUR and USWC services take June 1, 2020 as the base period and the base index is 1,000 points.

II. Rate information collection and panelist

Frequency: weekly

Time: 0:00-13:00 BJT each Monday

Range: voyages with ATD from ranging between 0:00 BJT last Monday and 24:00 BJT this Sunday (a day ago) .JSON format via API to Shanghai Shipping Exchange (SSE) and such API operation must be in a closed loop.

Panelists (member of EUR and USWC lanes sub-committee of China Export Containerized Freight Index Panel):

CMA CGM (China) Shipping Co., Ltd.

COSCO Shipping Lines Co., Ltd.

Evergreen Marine Corp. (Taiwan) Ltd.

Hapag-Lloyd (China) Shipping Ltd.

Maersk (China) Shipping Co., Ltd.

Mediterranean Shipping Company (Shanghai) Ltd.

Ocean Network Express (China) Ltd.

Orient Overseas Container Line (China) Co., Ltd.

Yang Ming Marine Transport Corp.

HMM (China) Co., Ltd.

Shanghai Syntrans International Logistics Co., Ltd.

YQN Logistics Co., Ltd.

Worldwide Logistics Co., Ltd.

JHJ International Transportation Co., Ltd.

Shanghai Shendong Shipping Co., Ltd.

III. Method of index compilation

1. In normal cases, the index is calculated as below:

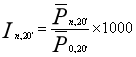

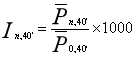

Firstly calculate the average rates by container type and trade lane using the below formula:

Secondly calculate the benchmarking price index by container type and trade lane using the below formula:

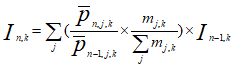

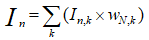

Thirdly calculate the index of SCFIS EUR/USWC using the below formula:

2. In case of no service schedule of several liner operators, failure of cyber or electricity system, or other abnormal circumstances, index will be compiled in an emergency way using the below methods:

If in the required time range more than one-third of the sampling container lines have no rate information to report or for a certain container type less than five panelists (1≦panelists<5) can tender rate information, while the number of panelists still meets the requirement on minimum panelists, the emergency index is then calculated by a chain weighting method in the same caliber (that is, the sampling panelists reporting rate data in both current time range and the previous time range).

If the number of sampling panelists in the current time range meets the requirement on minimum panelists but the rate data for a certain container type is not available in the same time range, the weight of such container type is assigned to another type, and the index

of this trade lane is calculated on the basis of the index of such type

of this trade lane is calculated on the basis of the index of such type  .

.

If the number of sampling panelists in the current time range fails to meet the requirement on minimum panelists, the index is calculated as below: firstly for the panelists with available rate data, use the chain weighting method in the same caliber to get the week-on-week change of index for the specific service lane

%; secondly use the data in the previous time range for the panelists with no settled rates in this time range, get the week-on-week change of index for the specific service lane

%; secondly use the data in the previous time range for the panelists with no settled rates in this time range, get the week-on-week change of index for the specific service lane  % (

% (  %=0), and make weighed calculation of

%=0), and make weighed calculation of  % and

% and  % to get the week-on-week change

% to get the week-on-week change  %; fourthly the SCFIS sub-index of the specific service lane in the previous time range is multiplied by (1+

%; fourthly the SCFIS sub-index of the specific service lane in the previous time range is multiplied by (1+  %) to get the emergency index of such service lane in this time range.

%) to get the emergency index of such service lane in this time range. IV. Publishing time

The SCFIS is published every Monday at 15:05 BJT. If Monday is not a working day, SSE may still publish the index on Monday or postpone it. In the last week of each year, SSE should on its official website announce the schedule of index publishing dates for the next year.

V. Disclaimer

Careful perusal of the disclaimer prior to usage of the rules is recommended. The user may choose not to use this document, but the usage should be deemed as acknowledgement and acceptance of the disclaimer.

The document, in particular, the English version thereof, is for reference only and in no case should constitute the guiding basis, trading direction or advice on any shipping and logistics service contract, securities, financial product or other investment instruments or any transaction policy. SSE has the liberty to amend the rules at any time without notification. SSE endeavors to ensure the accuracy of the contents herein but has no obligation to guarantee its accuracy, completeness or reliability. SSE shall not be held liable for any loss or liability arising from the direct or indirect use of document or any of its content.

The Chinese version of the document shall prevail under all circumstances.