For the purpose of meeting the demand of timeliness, precision and sensitivity of freight rates in the Southeast Asia container shipping market, fully reflecting the market conditions in the area, and perfecting SCFI index serials, Southeast Asia Freight Index (referred to as " SEAFI ") was official launched in January 10th,2025.

I. General Conditions of SEAFI

SEAFI reflects the spot rate changes of export containers on the services from Shanghai to Southeast Asia base ports. It includes freight rates (indices) of 6 individual shipping routes and a Southeast Asia index.

i. Freight rates of individual shipping routes

The individual shipping routes reflect the ocean freight and the associated seaborne surcharges of individual shipping routes on the spot market, where:

Shipping routes: covering major export container trade routes from Shanghai to the following regions of Southeast Asia:

Singapore, Vietnam, Thailand, Philippine, Malaysia and Indonesia.

Ports of destination: the base ports were defined in each individual trade route, e.g.

Singapore-Singapore;

Vietnam-Ho Chi Minh City;

Thailand-Laem Chabang;

Philippine-Manila;

Malaysia-Port Kelang;

Indonesia-Jakarta

Price type: The defined price is based on the spot market, under the CIF term, focusing on the mainstream trading price, with a statistic concept as "mode", of the sporadic, non-batch container space-bookings by common cargo owners, excluding the prices of long-term agreements or big customers. This price is not affected by the special service requirements.

Freight Composition: including freight rates and seaborne surcharges related to seaborne operational costs as bunker, currency, and equipment reposition and risks as war, port congestion and etc., excluding terminal handling, space-booking, document charges.

Unit: USD/TEU

Trade and transport term: export CIF, CY-CY, only for direct calling service, not for transhipment.

Container type/cargo description: General dry cargo container, excluding special, reefer and hazardous article containers.

ii. Southeast Asia Freight Index

The Southeast Asia Freight Index takes November 30, 2015 as the base period with the base period index of 503.39 points.

II. Freight Information Collection and Panelists

The freight rates for SEAFI compilation is reported by CCFI panelists, including liner companies and shipper/freight forwarders. All member panelists are world-renowned enterprises with outstanding performances and sound reputation in shipping circle.

III. Index Compilation and Publication

i. Freight calculation of individual shipping route

The freight rate of individual shipping route is the arithmetic mean of all freight rates on each route.

Where: i = route, j = sample company, n = number of sample companies on the route, = rates reported by sample company (j) on the route (i) in the current period;

= rates reported by sample company (j) on the route (i) in the current period;

ii. Calculation of Southeast Asia Freight Index

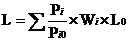

The Southeast Asia Freight Index adopts the computational formula of Laspeyres index.

Where:  = average rate of the route (i) in the current period;

= average rate of the route (i) in the current period;  = average rate of the route (i) in the base period;

= average rate of the route (i) in the base period;  = weighting of route (i);

= weighting of route (i);  = Southeast Asia Freight Index value on the base period.

= Southeast Asia Freight Index value on the base period.

iii. Index publication

SEAFI is generally publicized by SSE on Fridays.