To promote the cross-straits trade and cooperation, accelerate the development of Taiwan cross-straits direct sailing, reflect the trend of relationship between supply and demand as well as the change of freight rate and provide decision reference for the market participants and government economy macro-control, under the guidance of Ministry of Transport, Shanghai Shipping Exchange (hereinafter referred as "SSE") in cooperation with Xiamen Shipping Exchange developed the Taiwan cross-straits container Freight Index (TWFI) (hereinafter referred as "TWFI"). The index was launched on 27th November 2014.

1. The Index, Route and Base Ports

TWFI consists of one composite index, two component indices (i.e. TWFI import index, TWFI export index) and six route indices. The six routes are listed below: North China- Taiwan, East China - Taiwan, Southeast China- Taiwan, Taiwan – North China, Taiwan - East China, Taiwan – Southeast China. The base period of the composite index, component indices and relevant route indices are set on 22nd January, 2014, with base index of 1,000 points. The detail of the base ports of the six routes are listed below:

East China: Shanghai.

North China: Tianjin, Qingdao.

Southeast China: Xiamen, Fuzhou.

East China: Shanghai.

2. The Index Calculation

(1)The sub route index is calculated by Laplace index method and the calculation method is listed as below:

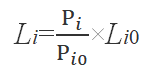

Where: ![]() is the route(i) index in the current period;

is the route(i) index in the current period;

![]() is the route(i) index in the base period (The base period of composite index is set on 22nd January, 2014, with base index of 1,000 points);

is the route(i) index in the base period (The base period of composite index is set on 22nd January, 2014, with base index of 1,000 points);

![]() is the average rate of the route(i) in the base period;

is the average rate of the route(i) in the base period;

![]() is the average rate of the route(i) in the current period and it is calculated using weighted average method with the method listed as below:

is the average rate of the route(i) in the current period and it is calculated using weighted average method with the method listed as below:

![]()

Where: n is the number of the sample company on the specific route i;

![]() is the weighting of the company j on the specific route i;

is the weighting of the company j on the specific route i;

![]() is the freight income per unit box of company j on the specific route i including ocean freight, Emergency Bunker Surcharge, Container Imbalance Charge, Origin Terminal Handling Charge, Destination Terminal Handling Charge and other relevant seaborne surcharges.

is the freight income per unit box of company j on the specific route i including ocean freight, Emergency Bunker Surcharge, Container Imbalance Charge, Origin Terminal Handling Charge, Destination Terminal Handling Charge and other relevant seaborne surcharges.

(2)The two component indices are the weighted averages of relevant sub route indices and the calculation method is listed below:

![]()

Where: m is the number of the sub routes; ![]() is the weighting of the route(i);

is the weighting of the route(i); ![]() is the component index value of the base period;

is the component index value of the base period;

(3)The composite index is the weighted average of two component indices and the calculation formula is listed as below:

![]()

Where: ![]() is the import index;

is the import index; ![]() is the weighting of import index;

is the weighting of import index;![]() is the export index;

is the export index; ![]() is the weighting of export index.

is the weighting of export index.

3. The panelist

The sample companies are those who are involved in the trade on the specific routes of TWFI. The company names are listed as below: COSCO Shipping Lines Co., Ltd., Sinotrans Container Lines, SITC Container Lines, Shanghai Jin Jiang Shipping, Shanghai Min Sheng Shipping, China United Lines, Fujian Huarong Marine Shipping Group Corporation, Fujian Waimao Shipping, Fujian Orient Shipping Co.,LTD, OOCL, EVERGREEN MARINE CORP. (TAIWAN) LTD., Yang Ming Marine Transport Corp, COASTAL LINE NAVIGATION CO.,LTD., Wan Hai Lines Ltd., Taiwan Xishu Shipping, Kanway International Co., Ltd., T.S. Lines Ltd.

4. Index publication

Shanghai Shipping Exchange and Xiamen Shipping Exchange issue TWFI on each Wednesday afternoon (holidays excluded). Users can log on the website of Shanghai Shipping Exchange or Xiamen Shipping Exchange to get the latest information of TWFI. It is also noteworthy that the release of TWFI may be cancelled or delayed if necessary and reasonable.